Does Solar Loan Affect Debt to Income Ratio?

Installing solar panels can reduce energy bills, but the upfront cost can be daunting. Solar loans allow homeowners to finance solar panel systems by borrowing money and paying it back over time. The loans enable more households to access the benefits of solar power.

However, some wonder if adding a solar loan could negatively impact their finances. One key metric lenders consider is debt-to-income (DTI) ratio—the percentage of your gross income devoted to debt payments. Generally, a lower DTI signifies better financial health.

This article explores how solar loans can affect DTI ratios. You’ll learn how loan size, terms, interest rates, and more influence impact on DTI. You’ll also discover strategies to minimize increases to your ratio from solar loans. If you’re weighing solar loans but worried about effects on financial standing, read on to make the most informed decision.

Overview on Solar Loans

Definition and Purpose of Solar Loans

Solar loans are financial instruments specifically designed to support individuals or businesses in financing the installation of solar energy systems. The primary purpose of solar loans is to enable the adoption of renewable energy solutions, such as solar panels, by providing accessible and structured financing options.

Types of Solar Financing Options

Several types of solar financing options cater to diverse financial needs and preferences. These options may include solar leases, power purchase agreements (PPAs), unsecured solar loans, and secured solar loans. Each type has its unique features, terms, and eligibility criteria.

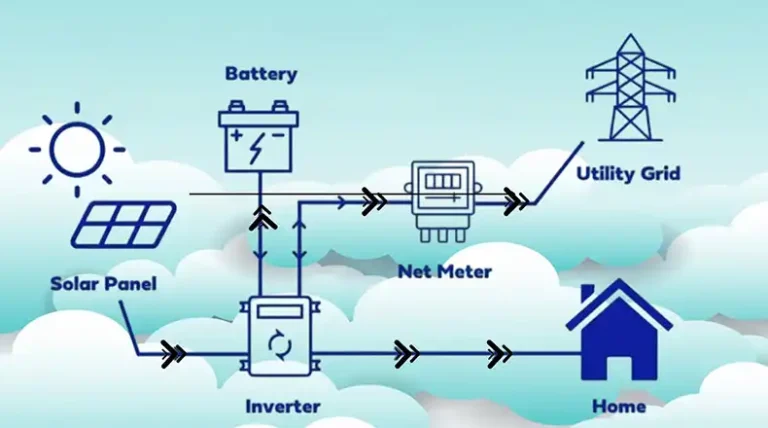

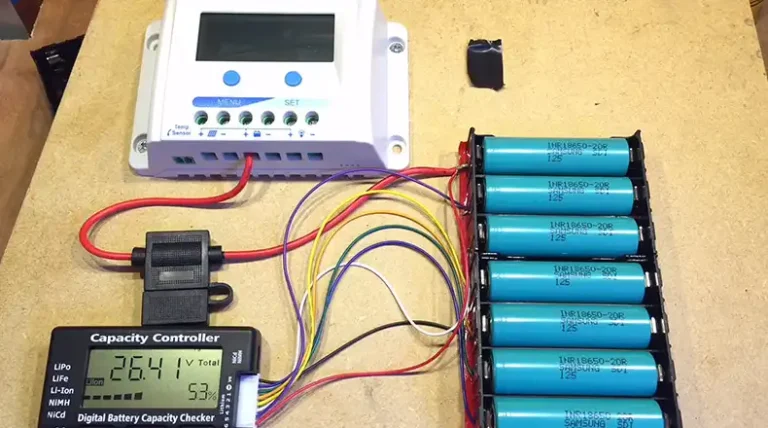

How Solar Loans Work

Solar loans provide financing for the upfront cost of purchasing a solar PV system. Loans typically range from 10-20 years with interest rates between 3-8%.

Knowledge of Debt-to-Income Ratio (DTI)

What is the Debt-to-Income Ratio?

A debt-to-income ratio compares the amount of debt a person has to their total gross income. It is a metric used by lenders to assess creditworthiness for loans. Generally, a DTI below 35% is considered manageable.

DTI Calculation

The DTI ratio is calculated by dividing the total monthly debt payments by the gross monthly income. The resulting percentage reflects the portion of income allocated to debt obligations, encompassing housing, consumer, and other debts.

Significance in Lending and Financial Decision-Making

Lenders use the DTI ratio as a benchmark to assess a borrower’s financial health and ability to take on additional debt. A lower DTI ratio indicates a more favorable balance between income and debt, making borrowers less risky and potentially eligible for loans at better terms and interest rates.

This overview provides essential insights into the definition, purpose, and types of solar loans, as well as a comprehensive understanding of the debt-to-income ratio and its significance in lending and financial decision-making.

Does Solar Loan Affect Debt-to-Income Ratio?

Taking out a solar loan to finance renewable energy systems for your home is an investment that can yield many long-term benefits. However, the additional monthly loan repayment responsibility has raised questions around whether securing solar financing could unfavorably impact a homeowner’s financial assessment metrics, particularly their debt-to-income (DTI) ratio.

Yes, a solar loan may increase your DTI ratio. But with responsible borrowing and smart financial planning, a solar loan can be managed without adverse effects on your finances.

Your DTI ratio compares the minimum monthly payments on all your current debts to your gross monthly income. Generally, lenders prefer to see DTIs below 36%. As your DTI ratio increases above that threshold, you may have more difficulty qualifying for new loans or mortgages.

The key is borrowing wisely for your situation. When sized properly, loans for solar power systems can provide energy bill savings that largely offset loan repayment amounts, minimizing DTI impact. Additionally, extending loan terms, making extra principal payments, or using government incentives can assist with cost management.

Careful upfront financial planning and budgeting, combined with responsible borrowing, allows most homeowners to reap solar energy incentives without solar loans adversely affecting their finances. As lending practices and attitudes toward renewable energy evolve, solar loan products will likely become even more tailored to homeowner DTI considerations.

Strategies for Managing Debt With a New Solar Energy System Loan

Taking on a solar loan allows homeowners to access renewable energy savings. But like any additional debt, a solar loan can negatively impact the key financial metric of debt-to-income (DTI) ratio. If you want to enjoy the long-term solar energy benefits without straining your DTI, proactive planning and management is vital.

The Key is Keeping Loan Costs Aligned With Your Budget

When scoped properly and paired with responsible borrowing, solar loans offer energy bill reductions that largely offset monthly loan repayment amounts. This minimizes the impact to your DTI ratio. The key strategies for maintaining budget alignment include:

- Accurately right-sizing your solar PV system to match usage

- Extending loan terms for lower payments

- Making extra principal payments to pay off interest faster

- Using government incentives and programs to reduce costs

Ongoing budgeting and money management will enable managing solar debt without DTI ratio increases. As lending and renewable energy investment options progress, solar loans will likely provide even more customized solutions for homeowner financial needs and constraints.

What Debts Are Included in The Debt-to-Income Calculation?

When lenders assess a borrower’s eligibility for additional credit, one vital metric examined is their debt-to-income (DTI) ratio. This compares existing monthly debt payments against gross monthly income to gauge capacity to take on more. As renewable energy loans grow increasingly popular, homeowners often wonder – what all debt obligations does the DTI calculation encompass?

Housing, Consumer Debts…And Potentially More

Lenders use the debt-to-income (DTI) ratio to weigh ability to take on additional loans. This requires tallying all current monthly debt payments and dividing them by gross monthly income. But what specifically gets defined as “debt”?

Housing Debt Factors: Mortgage payments, property taxes, homeowners insurance, and homeowner association fees comprise housing debt obligations in DTI calculations.

Consumer Debt Variables: Credit card bills, auto loan payments, student loan responsibilities, and installments for personal unsecured debts are common consumer debt elements of the DTI computation.

Potential Other Debt Considerations: Depending on individual financial circumstances, lenders may also account for other debts like child support, alimony, healthcare expenses, and existing solar or home improvement loans when evaluating DTI.

As adoption of renewable solar energy expands, lending practices and qualification guidelines will likely evolve to promote responsible borrowing aligned with homeowners’ DTI constraints. But for now, your full range of obligations may influence solar loan approval.

Securing Solar Financing When Your Debt-to-Income Ratio Levels Are High

With rising eco-consciousness, interest in installing solar panels continues growing. However, if your existing debt obligations already strain your debt-to-income ratio, obtaining financing may prove challenging. While no magic bullet, strategic planning around a few key areas can aid your loan approval likelihood.

Weigh Secured Lending Options

Leveraging your home’s equity or another asset as collateral through a secured lending avenue increases feasibility. The asset backs the borrowing, satisfying lenders despite higher debt ratios. Just ensure you can manage payments to avoid default risks.

Research State and Local Incentives

Thousands in tax credits, rebates, and savings from government solar incentives or utilities can instantly slash both system costs and required borrowing. Lower loan requirements align better with constrained budgets.

Explore Loan Qualification Criteria

Lending practices evolve, so research where wider DTI tolerances may apply. For example, certain loan products designed for eco-upgrades or based on projected energy savings rather than income may provide solar financing paths if you fall outside strict brackets.

The key is thoroughly investigating all avenues available rather than assuming qualification denial. With diligence and planning, those with higher debt can still transition to budget-friendly solar power.

Is a 30% Debt Level Still Considered Financially Healthy?

As interest grows in installing residential solar panels to lock in long-term energy savings, many prudent homeowners pause to weigh the potential financial impact and budget alignment. Specifically, how might taking on a new solar loan affect a previously sound debt-to-income (DTI) ratio? Historically, maintaining debt obligations below 30% of gross monthly income is ideal. But does surpassing this threshold by financing green energy automatically equate to overextending your finances?

Yes, a 30% debt level is still considered financially healthy. This DTI ratio indicates responsible debt management, making borrowers more attractive to lenders and enhancing their chances of securing credit at favorable terms.

It Depends on Your Situation and Goals

For most, keeping total debts including a new solar loan below 30% of income remains a sustainable target. This retains budget breathing room to accommodate unexpected expenses or income disruptions. However, for eco-motivated homeowners focused on slashing electricity bills over the long haul, a slightly higher DTI may prove worthwhile. The key is analyzing your unique habits.

Do you reliably make on-time loan payments? Do energy tax incentives, rebates, and long-term solar savings provide confidence in managing marginally higher obligations? If a solar loan allows staying under 35% DTI, the clean energy payoffs could justify tweaking the budget. As lending attitudes toward renewable projects progress, loan products will likely become more attuned to maximizing access while mitigating overextension risk.

Do All Monthly Expenses Factor Into The Debt-to-Income Metric?

Contrary to common belief, a debt-to-income (DTI) ratio does not encompass all monthly expenses. The DTI ratio calculation is specific and only considers certain types of debt payments, excluding various other expenditures crucial for daily living.

The DTI ratio includes housing, consumer, and other debt payments. Housing debt comprises mortgage payments, property taxes, homeowners insurance, and homeowner association (HOA) fees. Consumer debt involves payments on credit cards, car loans, personal loans, and student loans. Other debt encompasses obligations like child support or alimony payments.

However, it’s important to note that not all monthly expenses are part of the DTI ratio calculation.

Expenses such as utilities, food, clothing, and entertainment are not factored into the DTI ratio. These are considered necessary living expenses but are not classified as debt, nor are they included in the lender’s evaluation of a borrower’s ability to repay a loan.

No, a debt-to-income ratio does not include all expenses. While it considers specific types of debt payments crucial for financial assessment, everyday living expenses are not part of the DTI ratio calculation.

Which Matters More – Debt Levels or Credit Scores?

Debt-to-income (DTI) ratio and credit score both play vital roles in the loan application evaluation process, yet their significance can vary based on the lender and the specific type of loan sought.

DTI Ratio: This metric gauges the amount of debt a borrower holds relative to their income. A lower DTI ratio suggests that a borrower has a reduced level of debt concerning their income, portraying them as less risky for lenders.

Credit Score: This numeric representation reflects a borrower’s creditworthiness, considering factors such as payment history, outstanding debts, credit history length, and types of credit used. A higher credit score signifies lower risk and a higher likelihood of timely loan repayment.

Determining Loan Repayment Ability: The DTI ratio and credit score jointly contribute to assessing a borrower’s ability to repay a loan. However, the weight assigned to each factor can fluctuate, influenced by the lender’s policies and the nature of the loan.

Variability Across Loan Types: Mortgage vs. Unsecured Personal Loan:** For instance, a lender might prioritize a high credit score and be more lenient on a slightly elevated DTI ratio when approving a mortgage loan compared to an unsecured personal loan.

The importance of DTI ratio and credit score varies depending on the lender and the type of loan. While both are critical in evaluating loan repayment ability, there isn’t a one-size-fits-all answer. Borrowers should comprehend their DTI ratio and credit score, aiming to enhance both metrics to maximize approval chances for loans at favorable terms and interest rates.

Advantages and Disadvantages of Solar Loans

Describing the potential benefits and challenges associated with solar loans provides valuable insights for individuals contemplating renewable energy investments.

Pros of Including Solar Loans in DTI

Solar loans, when factored into the debt-to-income (DTI) ratio, can offer various advantages for individuals considering renewable energy investments. Incorporating solar loans into the DTI ratio can positively impact a borrower’s financial profile. Here are some key advantages to consider:

1. Long-Term Cost Savings: Investing in solar energy often results in reduced monthly utility bills, contributing to long-term cost savings.

2. Environmental Benefits: Financing solar installations aligns with sustainable practices, fostering a positive environmental impact.

3. Improved Home Value: Solar panels can enhance property value, potentially offering a return on investment when selling the home.

4. Access to Government Incentives: Some regions provide incentives, tax credits, or rebates for solar installations, making the loan more financially attractive.

5. Positive Lender Perception: Lenders may view investments in renewable energy favorably, potentially increasing the likelihood of loan approval.

Potential Drawbacks and Challenges

While there are advantages, it’s essential to consider potential drawbacks and challenges associated with including solar loans in the DTI calculation. Understanding the potential downsides can help borrowers make informed decisions:

1. Upfront Costs: Solar installations may require significant upfront costs, impacting immediate financial liquidity.

2. Lengthy Payback Period: The return on investment from solar panels might take several years, extending the time to realize significant savings.

3. Technological Advances: Rapid advancements in solar technology could lead to potential obsolescence, affecting the long-term value of the investment.

4. Impact on DTI Ratio: Including solar loans may increase the DTI ratio, potentially affecting eligibility for other types of credit.

5. Market Variability: Changes in solar market conditions, government incentives, or energy policies can impact the overall economic viability of solar investments.

Understanding both the advantages and potential challenges associated with incorporating solar loans into the DTI ratio is crucial for making well-informed decisions on sustainable and financially responsible investments.

People Also Ask (PAA)

Q1. What credit score is needed to qualify for the best solar loan rates?

A: Most lenders offer the lowest interest rates between 720 to 850 credit score. Maintaining at least 680 can still yield competitive solar loan pricing.

Q2. How do solar loans compare to solar leases or PPAs in terms of impact on DTI ratio?

A: Solar leases and Power Purchase Agreements (PPAs) provide solar energy without upfront panel purchase costs. This avoids potential debt impact on your DTI ratio. Loans do add to debt obligations.

Q3. Can you deduct solar loan interest from federal income taxes?

A: Yes. With solar loans, the interest portion of your payments is tax deductible, providing savings. Leases/PPAs don’t offer deductions.

Q4. Do all lenders factor new solar loan debt into DTI ratio calculations?

A: Not necessarily. More lenders are embracing renewable projects, with some willing to exclude solar loans from strict financial assessments after analyzing projected energy savings.

Q5. How can I plan for DTI ratio impacts from going solar?

A: Thorough budgeting and sizing your system responsibly to match usage rather than max production ability lets you predict and manage solar loan effects on your ratio.

End Notes

Adding a solar loan can increase the debt-to-income ratio, but responsible borrowing aligned with your budget makes impacts manageable without overextending finances. Moreover, the value proposition remains strong – projected energy bill savings enabled by solar power systems tend to counterbalance loan costs over time. With sound financial planning for both system sizing and financing terms, you can enjoy the solar benefits without adverse debt or DTI effects.