How Does IRS Verify Solar Credit | Simple Guideline

Solar panels need to obtain certification from the Solar Rating Certification Corporation or an equivalent organization approved by your state.

Beyond being an eco-conscious choice, this tax credit can significantly slash your tax bill. But claiming it isn’t as simple as a wave of a wand; you need to navigate the IRS terrain using the formidable Form 5695.

Wondering how to tread this path? Fear not! This article is your guiding light through the intricacies of IRS verification for the Solar Tax Credit.

Residential Renewable Energy Tax Credit

In the realm of tax incentives and energy-conscious initiatives, the Residential Renewable Energy Tax Credit stands out as a beacon of financial relief for homeowners embracing solar energy solutions.

This credit, commonly referred to as the Solar Tax Credit, has become a significant driver for individuals seeking to harness the power of the sun to reduce both their carbon footprint and energy bills.

Decoding the Residential Renewable Energy Tax Credit

The Residential Renewable Energy Tax Credit, often dubbed the Solar Tax Credit, is a federal program designed to encourage the adoption of renewable energy sources, particularly solar power, in residential settings.

This credit serves as a tangible reward for homeowners making the eco-conscious choice to invest in solar panel installations.

Eligibility Criteria for Solar Credits

Understanding the eligibility criteria is paramount for those seeking to harness the power of solar tax credits. The IRS scrutinizes various aspects to ensure that only deserving candidates receive the financial benefits associated with renewable energy initiatives.

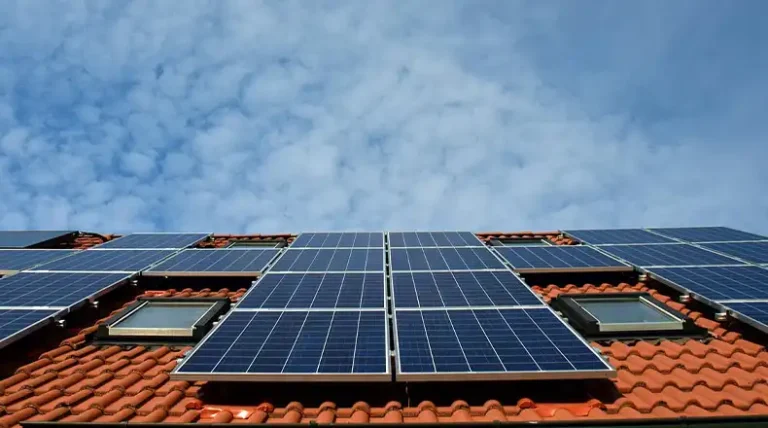

Residential Solar Installation Requirements

For homeowners looking to claim solar credits, adherence to specific installation requirements is crucial. The IRS mandates that residential solar panel systems meet certain specifications to qualify for the credit. This includes not only the type of solar panels used but also considerations about ownership.

In the residential realm, the solar installation must adhere to predefined guidelines concerning panel efficiency, energy output, and overall system reliability. Homeowners should take note of these specifications to ensure their solar endeavors align with IRS expectations.

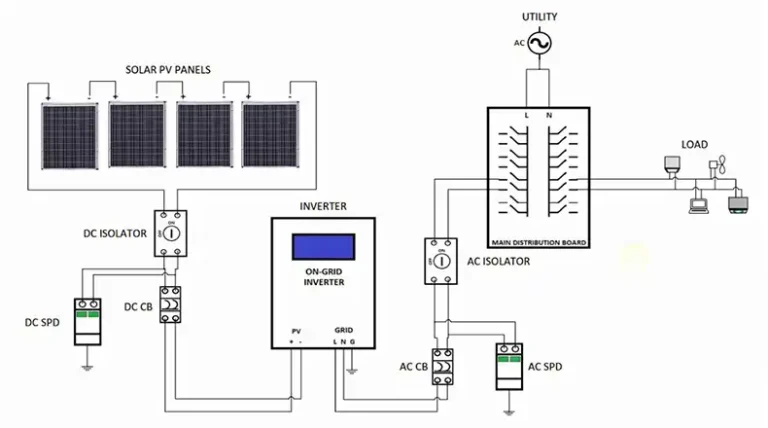

Commercial Solar Installation Requirements

The landscape changes when we shift our focus to commercial solar installations. Business entities venturing into solar projects must meet distinct criteria outlined by the IRS. From the type of business entity to the commencement dates of solar projects, every detail plays a pivotal role in determining eligibility.

Commercial solar ventures must adhere to IRS regulations regarding project initiation, ensuring that the timeline aligns with the stipulated guidelines. Moreover, the IRS scrutinizes the type of business entity involved, emphasizing the need for precision and compliance in commercial solar endeavors.

IRS Documentation for Solar Credits

In the world of solar energy, claiming tax credits is not just about the environmental impact but also about the financial benefits that come with it.

One crucial aspect that often raises questions is how the IRS verifies solar credits. Understanding the documentation process is key to ensuring a smooth and successful claim.

Required Forms and Schedules

When it comes to solar credits, the IRS has a specific set of forms and schedules to streamline the verification process. These are the essential documents you need to be familiar with to pave the way for your solar credit claim.

Form 5695 – Residential Energy Credits

This form serves as the cornerstone for homeowners seeking to claim the Residential Clean Energy Credit, commonly known as the Solar Tax Credit.

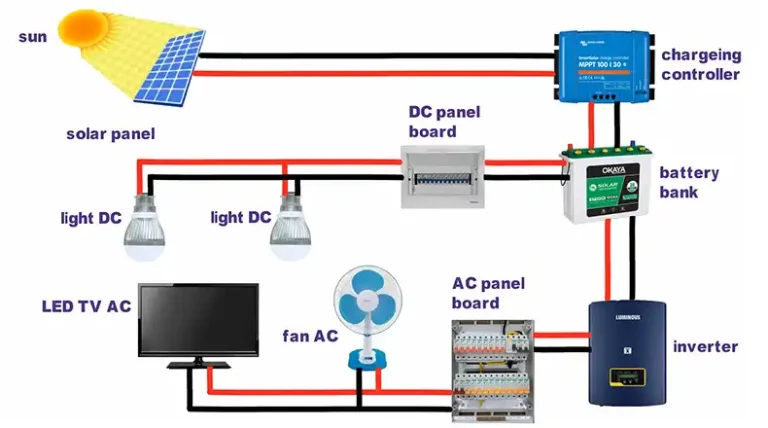

Form 5695 delves into the concept of Residential Energy Credits, providing a detailed breakdown of non-refundable credits for residential energy-efficient property. Eligible improvements include solar panel systems, solar energy storage, fuel cells, geothermal heat pumps, and small wind turbines.

Completing Form 5695 accurately is crucial, and individuals must adhere to specific eligibility criteria outlined by the IRS. Whether you’ve embraced solar for environmental reasons or financial incentives, this form is your gateway to potential tax savings.

Form 3468 – Investment Tax Credit

For those involved in commercial solar ventures, Form 3468 takes center stage. This document focuses on the Investment Tax Credit (ITC), a federal tax credit designed to encourage investments in renewable energy projects.

Commercial entities undertaking solar initiatives can benefit from a percentage-based tax credit calculated on the total cost of the solar energy system.

Understanding the intricacies of Form 3468 is vital for businesses aiming to maximize their tax incentives. From calculating tax credit values to navigating the complexities of commercial solar investments, this form plays a pivotal role in the verification process.

Schedule C – Business Income

Commercial solar installations bring a unique set of considerations, and Schedule C addresses the impact on business income. For businesses engaged in solar ventures, reporting accurate and detailed information on business income is crucial for the verification of solar credits.

This schedule ensures that businesses account for their solar-related activities appropriately, contributing to the overall verification process. It’s not just about claiming credits but also about aligning your solar investments with the IRS guidelines, ensuring compliance and maximizing your tax benefits.

Frequently Asked Questions

Q1: Why is IRS verification necessary for solar credits?

A1: IRS verification ensures that individuals and businesses claiming solar credits adhere to the specified guidelines and eligibility criteria. It helps maintain the integrity of the tax credit system and ensures that only legitimate solar installations receive the associated benefits.

Q2: What is the significance of Form 5695 in the verification process?

A2: Form 5695, also known as the Residential Energy Credits form, is crucial for homeowners claiming the Solar Tax Credit. It details the residential energy-efficient property improvements eligible for non-refundable credits. Accuracy in completing this form is paramount for a successful solar credit claim.

Q3: How does Form 3468 impact commercial solar ventures?

A3: Form 3468 focuses on the Investment Tax Credit (ITC) for commercial solar projects. It plays a vital role in calculating the tax credit percentage based on the total cost of the solar energy system. Businesses must navigate Form 3468 to maximize their tax incentives.

Q4: Can I claim solar credits if I don’t itemize deductions on Schedule A?

A4: Yes, taxpayers can claim solar credits using Form 5695 regardless of whether they itemize deductions on Schedule A. Solar credits are not dependent on itemization, making them accessible to a broader range of taxpayers.

Q5: What types of improvements are eligible for Residential Energy Credits?

A5: Eligible improvements for Residential Energy Credits, as outlined in Form 5695, include residential solar panel systems, solar energy storage, fuel cells, geothermal heat pumps, and small wind turbines. These improvements must meet specific energy efficiency requirements to qualify.

Q6: How does Schedule C impact businesses involved in solar ventures?

A6: Schedule C is crucial for businesses engaged in solar installations. It focuses on reporting business income related to solar activities. Accurate completion of Schedule C ensures businesses align with IRS guidelines, facilitating the verification process for commercial solar credits.

Q7: Can I claim solar credits if I’ve made additional energy-efficient improvements?

A7: Yes, individuals can claim solar credits for additional energy-efficient improvements by including them in Form 5695. These improvements may encompass home solar water heating, small wind energy generators, and geothermal heat pump property costs.

Q8: What happens if my documentation is incomplete during IRS verification?

A8: Incomplete documentation may result in delays or challenges during the verification process. It is essential to carefully organize and submit all required documents, following IRS guidelines to ensure a smooth verification and claiming process.

Q9: Are there specific timelines for IRS verification of solar credits?

A9: The timelines for IRS verification can vary, but it is advisable to submit all necessary documentation promptly. Timely submission enhances the chances of a seamless verification process and ensures that any potential issues are addressed promptly.

Q10: Can I carry over unused tax credits to the next tax year?

A10: Yes, if your tax liability is smaller than the tax credits you qualify for, you can calculate the amount you can claim on the next year’s taxes. This process is detailed in Form 5695, helping you maximize the benefits of your solar credits.

Conclusion

In conclusion, understanding the intricacies of Residential Renewable Energy Tax Credits is not just about saving money but also contributing to a sustainable and greener future.

Whether you’re a homeowner or a business owner venturing into the world of solar energy, this comprehensive guide equips you with the knowledge needed to navigate the solar tax credit landscape successfully.

Claiming your credits becomes not just a financial benefit but a step towards a cleaner and more energy-efficient tomorrow.